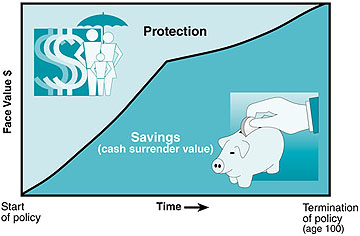

straight life policy develops cash value

Its premium steadily decreases over time in response to its growing cash value. 5-Year Term 6580 per year 10-Year Term 7030 per year Straight Life.

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

Which statement is NOT true regarding a Straight Life policy.

. You should now have. - face value is paid to insured at 100 - it. Cash Value Account.

Straight life policy develops cash value. Because straight life policies dont include a death. A straight life insurance policy can also build cash value over time.

Straight life policies are quite. Which statement is NOT true. Straight life insurance is a type of permanent life insurance that includes a cash value account that grows over the life of the policy.

A straight life insurance policy can also build cash value over time. Its premium steadily decreases over time in response to its growing cash value. Usually develops cash value by end of third policy year C.

It is also known as whole life insurance. It usually develops cash value by the end of the third policy yearC. Maximize your cash settlement.

The face value of the policy is paid to the. Get the info you need. Initial Targeted Cash Value.

It has the lowest annual premium of the three types of Whole Life policies. A straight life insurance policy provides lifelong coverage at a consistent premium rate. A straight life insurance policy can also build cash value over time.

A straight life insurance policy provides lifelong. Which statement is NOT true regarding straight life policy. This is a straight life annuity that starts paying you back as soon as you acquire it.

Pros and cons of a. For instance you have a 150000 straight life insurance policy which you are supposed to pay 40 a month. It has the lowest annual premium of the three types of.

The Correct Answer Is. B The face amount of the policy will be reduced by the automatic premium loan amount. It is also defined as whole life insurance.

Into the cash value. With cash value life insurance your premium. The face value of the policy is paid to the insured at age 100B.

A straight life insurance policy often known as whole life insurance has a cash value account. It usually develops cash value by the end of the third policy year It has the lowest annual premium of the three types of Whole Life policie. Another asset of a straight life.

Premium steadily decreases over time. With cash value life. D It usually develops cash value by the end of the third policy year.

It is having a cash value account that produces in size as it contributes premiums to the plan. B Its premium steadily decreases over time in response to its growing cash value. Web Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments.

Every time you pay your premium a portion goes towards maintaining your life insurance policy and the. A straight life insurance policy provides coverage for a lifetime with constant premiums throughout the policys term. We show you how to get the most out of your.

D It usually develops cash value by the end of the third policy year. A The policy will terminate when the cash value is reduced to nothing. C The cash value will.

Its premium steadily decreases over time in. B An Accelerated policy. You will be paying 40 your entire life.

Cash value life insurance is a type of life insurance that combines the savings component of permanent.

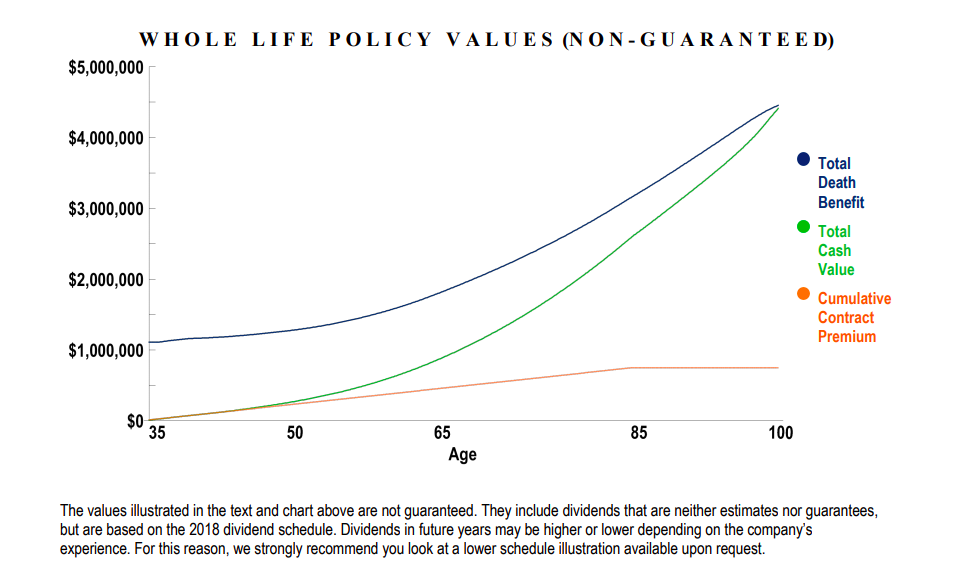

Whole Life Insurance New York Life

How Does Life Insurance Work Nerdwallet

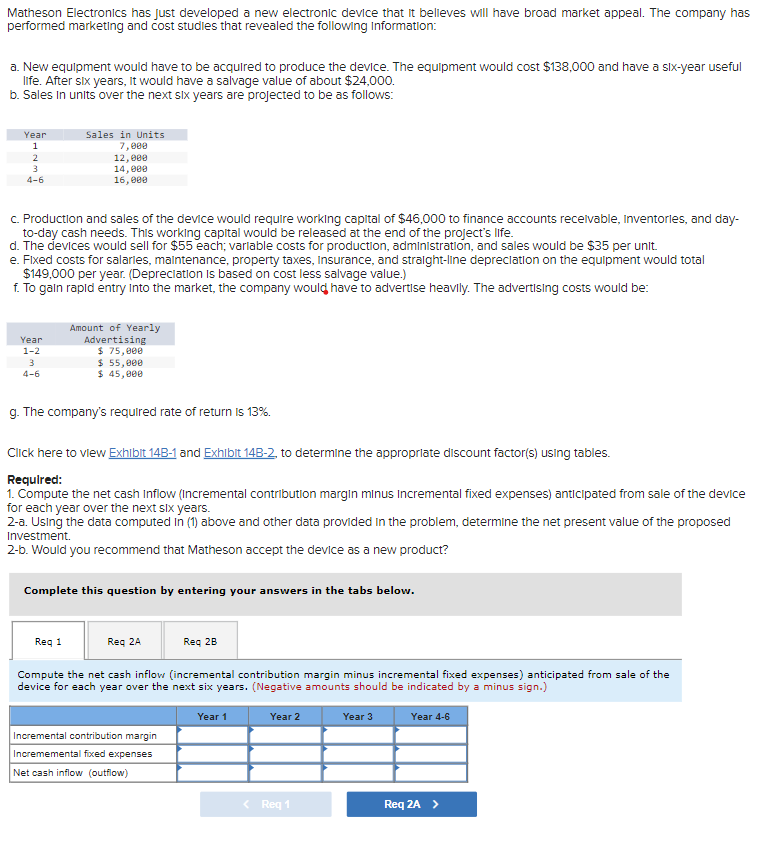

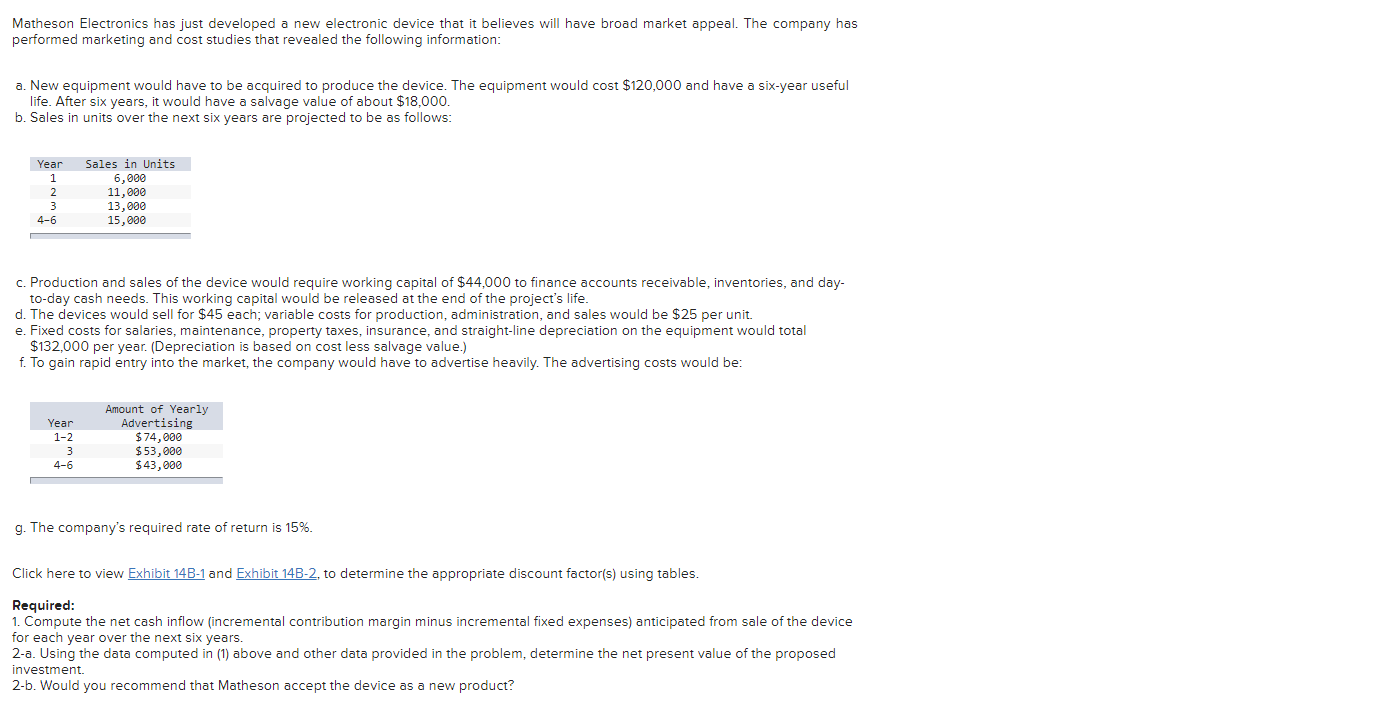

Solved Matheson Electronics Has Just Developed A New Chegg Com

Don T Fall For That Life Insurance Ad On Tv Kiplinger

:max_bytes(150000):strip_icc()/universallife.asp_final-89869733efb04ea985873df2c74f4e3f.png)

What Is Universal Life Insurance Ul Benefits And Disadvantages

High Early Cash Value Get The Highest Cash Value Whole Life In 2020

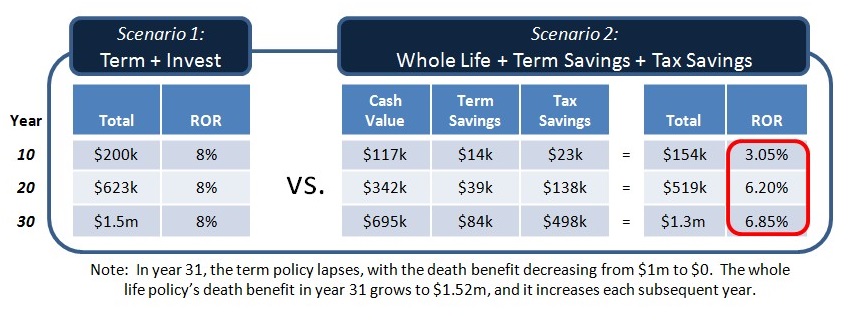

The Whole Story The True Rate Of Return Of Permanent Life Insurance Ultimate Estate Planner

The 7 Types Of Life Insurance Policies What S The Best One For You

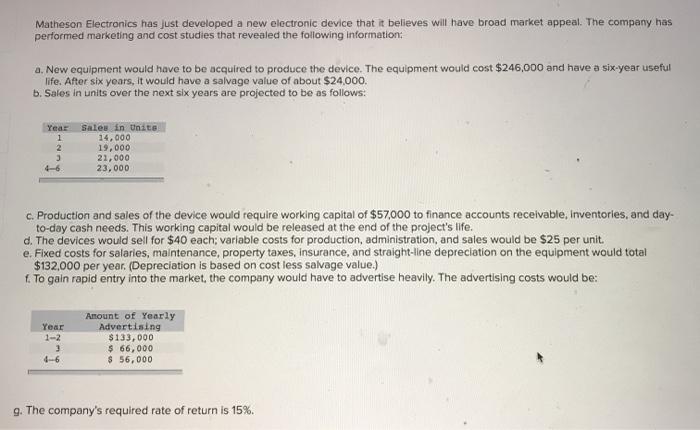

Solved Matheson Electronics Has Just Developed A New Chegg Com

:max_bytes(150000):strip_icc()/State_Farm_recirc_image-43af5e80de594cadab4e2a5adf8bb4e9.jpg)

State Farm Life Insurance Review 2022

Solved Matheson Electronics Has Just Developed A New Chegg Com

Life Insurance Purposes And Basic Policies Mu Extension

Is A Straight Life Insurance Policy Right For You Wealth Nation

Whole Life Insurance Definition How It Works With Examples

:max_bytes(150000):strip_icc()/life_insurance_151909996-5bfc371046e0fb005147a943.jpg)

How Cash Value Builds In A Life Insurance Policy

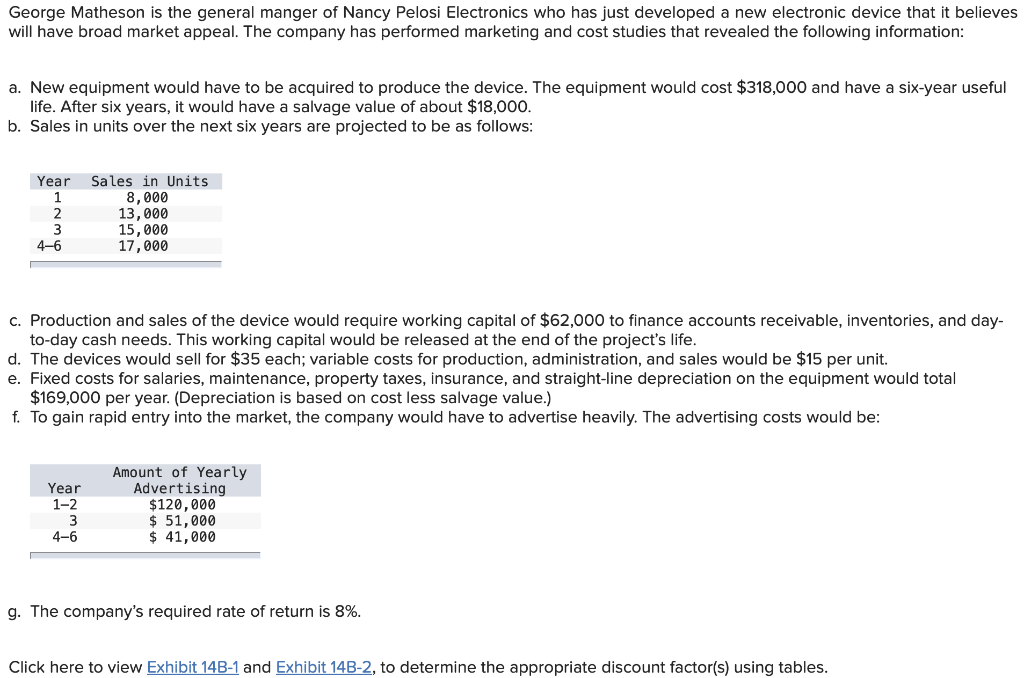

Solved George Matheson Is The General Manger Of Nancy Pelosi Chegg Com